Phoenix Legal Resource Blog

Will Bankruptcy Affect My Job or Employment in Phoenix?

If you’re considering filing for bankruptcy in Phoenix, you might be wondering if bankruptcy will affect your job or employment. It’s a fair concern—after all, financial challenges are stressful enough without worrying about your career.

Read more »of “Will Bankruptcy Affect My Job or Employment in Phoenix?”

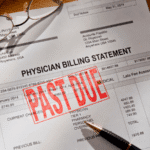

Will Bankruptcy Get Rid of Medical Debt in Phoenix?

Medical emergencies can strike without warning, and unfortunately, the financial aftermath often lingers long after the health crisis has passed. For many Phoenix residents, soaring hospital bills, out-of-pocket expenses, and gaps in insurance coverage lead to overwhelming medical debt. In these situations, a question often arises about whether bankruptcy will get rid of medical debt in Phoenix.

Read more »of “Will Bankruptcy Get Rid of Medical Debt in Phoenix?”

How Long Do Chapter 13 Bankruptcies Last in Phoenix?

If you’re exploring options to manage overwhelming debt, you’ve probably come across Chapter 13 bankruptcy as an alternative to liquidation under Chapter 7.

Read more »of “How Long Do Chapter 13 Bankruptcies Last in Phoenix?”

What Happens to My Tax Debt When I File for Bankruptcy in Phoenix?

If you’re drowning in debt and considering bankruptcy, you’re probably hoping for a clean slate—including relief from back taxes. But when it comes to tax debt and bankruptcy in Phoenix, things can get a bit complicated. The IRS doesn’t always go away quietly.

Read more »of “What Happens to My Tax Debt When I File for Bankruptcy in Phoenix?”

Can You Keep Your House in a Chapter 7 Bankruptcy in Phoenix?

If you’re struggling with debt and considering bankruptcy, one of your biggest worries is likely whether you will lose your home. It’s a fair concern that deserves a clear answer. The good news is that in Phoenix, you can keep your house in a Chapter 7 bankruptcy, but it depends on several key factors.

Read more »of “Can You Keep Your House in a Chapter 7 Bankruptcy in Phoenix?”

How Long Does Chapter 13 Bankruptcy Stay on Your Credit Report in Phoenix?

Filing for bankruptcy is a big step. But for many people in Phoenix, it’s the best way to get out from under crushing debt. But if you’re thinking about filing for Chapter 13, you’re probably wondering how long it’s going to affect your credit report.

Read more »of “How Long Does Chapter 13 Bankruptcy Stay on Your Credit Report in Phoenix?”

Can I File for Chapter 7 Bankruptcy More Than Once in Phoenix?

Filing for bankruptcy isn’t anyone’s first choice, but sometimes it’s your best option. If you’ve previously filed for Chapter 7 and find yourself in financial trouble again, you’re probably wondering if you can file for Chapter 7 bankruptcy again in Phoenix.

Read more »of “Can I File for Chapter 7 Bankruptcy More Than Once in Phoenix?”

Is SSI Included as Disposable Income for Bankruptcies?

When you’re facing overwhelming debt and seeking a fresh start, few questions loom larger than how your SSI included as disposable income might impact your bankruptcy filing. SSI stands for Supplemental Security Income, a federal program that provides financial support to individuals who are disabled, blind, or elderly with limited income and resources. Because SSI payments are a critical lifeline for many, understanding how they factor into bankruptcy is essential to safeguarding your financial stability.

Read more »of “Is SSI Included as Disposable Income for Bankruptcies?”

What Is a Bankruptcy Discharge?

A bankruptcy discharge is a court order that releases you from personal liability for certain debts. It essentially means creditors must stop trying to collect on these debts. This moment is often the most crucial part of the bankruptcy process, as it signifies the potential for a true financial reset. Below, we’ll explore what a discharge is, how it works, and why it matters.

Read more »of “What Is a Bankruptcy Discharge?”

How to Enjoy the Holidays Without Going into Debt

As we enter this festive period, it is important to consider how to enjoy the holidays without stretching your budget beyond its limits. Holidays like Christmas emphasize spending quality time with family and reflecting on the past year, but it’s also a time that is primed for overspending.

Read more »of “How to Enjoy the Holidays Without Going into Debt”