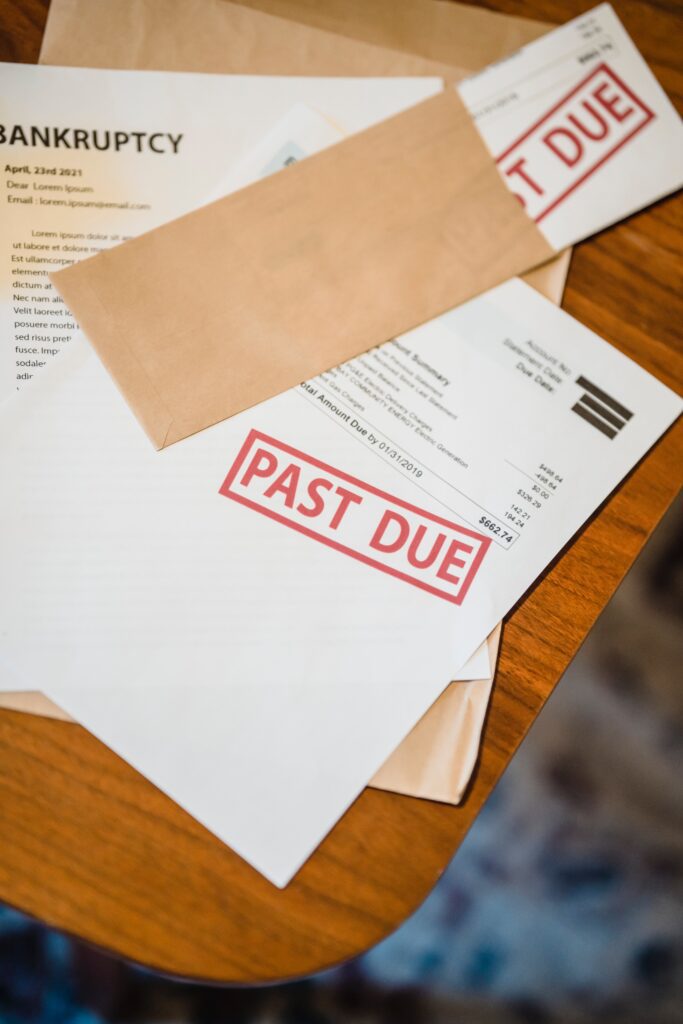

How to Know When to Consider Bankruptcy

If you are overwhelmed with debt and unable to get caught up on your payments, bankruptcy may be the right solution for you. Declaring bankruptcy is a major financial step that can affect your future. It is in your best interests to consult with an experienced bankruptcy attorney before filing.

What Is Bankruptcy?

Bankruptcy is a legal proceeding through which debtors may seek relief from all or a portion of their debts. It is initiated by a person who is unable to repay outstanding debts or obligations. The process begins with a petition filed in federal bankruptcy court by the debtor. Bankruptcy provides debt relief by discharging debts the petitioner cannot pay. It also gives creditors an opportunity for repayment from assets available for liquidation. Declaring bankruptcy can mean a fresh start for individuals who cannot afford to pay their bills.

What Are the Signs That Bankruptcy May Be Necessary?

If you are deep in debt with no relief in sight, bankruptcy may be the fastest way to get your head above water. The following are some signs that it may be time to file for bankruptcy:

- You are more than one month behind on your mortgage payments, or you have already received notice of foreclosure.

- You are behind and unable to get current with your car loan payments, or you have already received notice of repossession.

- You are unable to cover your basic monthly expenses without using credit, and you keep going further into debt.

- Creditors are making harassing phone calls, attempting to collect payments from you.

- Late payments, missed payments, and charge-offs are being reported to the credit bureaus, lowering your credit score.

- You are unable to make more than the minimum payments on your credit card bills, which are accruing more interest every month.

What Are the Different Types of Bankruptcy?

Individuals filing for bankruptcy can choose between Chapter 7 and Chapter 13.

- Chapter 7 allows for the discharge of unsecured debt, such as credit card bills and medical bills. If you have assets that are not exempt from bankruptcy, they may be seized and sold off to help clear your debt. Examples of non-exempt assets include valuable coin or stamp collections, family heirlooms, second homes, stocks, bonds, and other investments. Assets that are exempt include a personal vehicle up to a certain value, household goods, clothing, and the tools of a trade. People with no valuable non-exempt assets may not have to liquidate any of their property to clear debts, in which case Chapter 7 may be the best choice. Your average monthly income must be below a certain amount to meet eligibility requirements.

- Individuals with earnings too high to qualify for Chapter 7 may file for Chapter 13. This type of bankruptcy allows the debtor to create a manageable debt repayment plan, usually in installments over a three to five-year period. Debtors are allowed to keep all of their property with Chapter 13, which is also known as a wage earner’s plan. To be eligible, you must have sufficient income to make the monthly payments outlined in your plan, and your secured and unsecured debts must be under a certain amount.

What Are the Benefits of Filing Chapter 7 or Chapter 13?

Bankruptcy can discharge all or most of your debts, stop foreclosure on your home, stop repossession of your vehicle, restore, or prevent termination of utilities, and stop wage garnishment and creditor harassment. Call Hilltop Law Firm at (602) 466-9631. Our experienced Arizona bankruptcy attorneys can help you determine if Chapter 7 or Chapter 13 bankruptcy is your best debt solution.