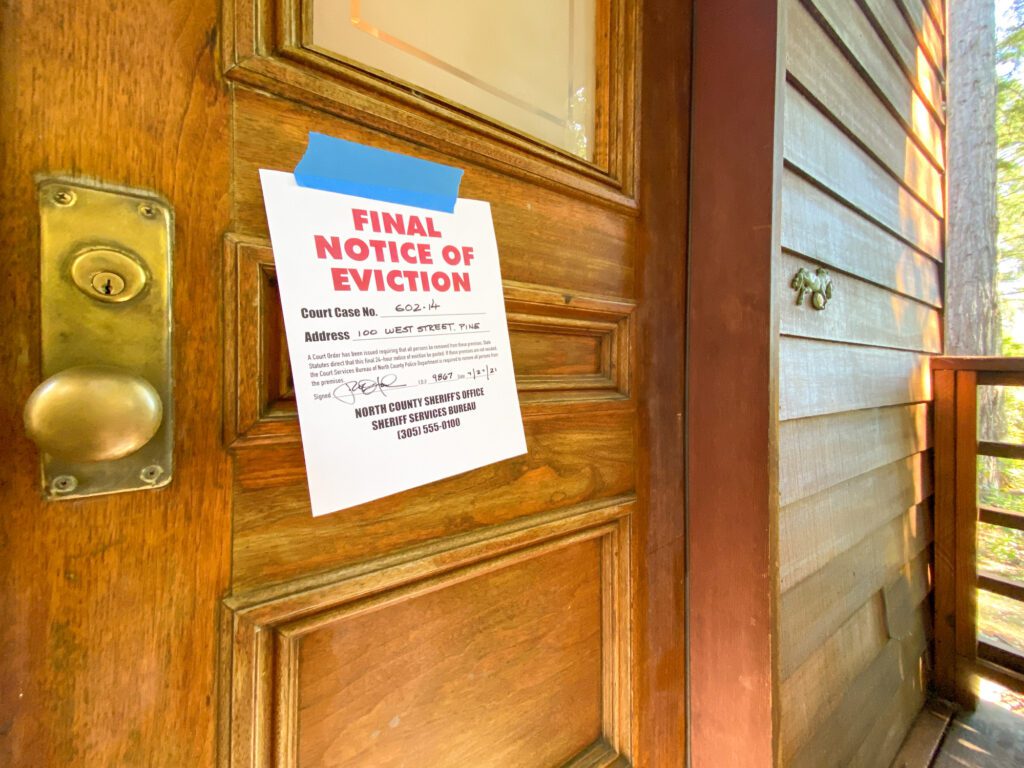

Can You Avoid Eviction with Bankruptcy?

If you rent your residence, and your landlord has threatened to evict you for failure to pay rent, filing for bankruptcy may help you avoid the eviction. Understanding the role of bankruptcy in avoiding eviction will help you figure out how to navigate difficult financial situations. Read on to find out how bankruptcy can prevent eviction and how you can implement it.

Can You Be Evicted After Filing for Bankruptcy?

In Arizona, a landlord can only evict you after filing an eviction lawsuit. However, an eviction notice will not be necessary if you abandon your premises or voluntarily surrender the premises. When you file for bankruptcy, you activate “automatic stay”, which goes into effect immediately. The automatic stay order prevents any attempt or action to collect on debts that you owe and prevents most legal lawsuits that could be filed against you.

Therefore, once you file for bankruptcy in Arizona, your residential landlord cannot sue you for past-due rent. The landlord cannot also file an eviction lawsuit against you in court. Note that if the landlord filed the lawsuit before you filed for bankruptcy, the automatic stay order would stop the lawsuit. In summary, as long as the eviction lawsuit has not been completed when you file for bankruptcy, the automatic stay order will stop the eviction process. This is how filing for bankruptcy can prevent your eviction in Arizona.

How Long Will Chapter 7 Bankruptcy Delay an Eviction?

Filing for Chapter 7 bankruptcy is a temporary fix against eviction in Arizona. Although the automatic stay stops the eviction lawsuit, your landlord can apply to the bankruptcy court to have the automatic stay lifted, which will allow the eviction to restart.

Courts typically grant such requests, so filing bankruptcy really just buys you some time to either catch up the rent or to secure alternative housing. It all depends on how fast the landlord files their petition and how soon they want you out of the property.

How Chapter 13 Bankruptcy Can Provide a Payment Plan for Unpaid Rent

The courts will still recognize your debts when you file for Chapter 13 bankruptcy. However, this move allows you to have enough time to devise a repayment plan to settle your unpaid rent. You have valuable time to get your finances right and offset your bills, allowing you to stay in your home. In Chapter 13 bankruptcy, you may receive a three- to- five- year repayment plan to settle your rent. Like Chapter 7, Chapter 13 stops home foreclosure and creditor harassment.

Are There Cases Where Bankruptcy Cannot Stop eviction?

Here are two cases where bankruptcy will not stop an eviction in Arizona.

- The first case is where the landlord had obtained judgment for possession of the property before you filed for bankruptcy. The court order gives the landlord entitlement to take possession of the property. If the landlord gets this order before you file for bankruptcy, there is little you can do to prevent them from evicting you.

- Secondly, bankruptcy can fail to prevent eviction when the landlord claims you are endangering the property. Claims that you are using drugs on the property can also render filing for bankruptcy inconsequential. Therefore, it is crucial to have a lawyer that can interpret all these possible scenarios in your case.

How Our Phoenix Bankruptcy Lawyers Can Help

When you schedule a consultation at Hilltop Law Firm, our Phoenix bankruptcy attorneys will review your case and advise you on the best step forward. We will walk with you every step of the way and help you get the time you need to offset your debts. Call our offices today at (602) 466-9631 to schedule your appointment.